Mining and mining services companies are entering a new paradigm; propelled by advancing technology and artificial intelligence, the segment’s “path to payback” for some of its main capital expenditures is being cut in half in some cases, according to Dermot Ryan, AMP Capital’s Multi Asset Group, direct equities, portfolio manager.

The cyclicality of mining and mining services means companies in the segment predictably go through periods of capital expenditure, followed by periods of operational cash flow, before they’re able to return capital to shareholders and the process starts again.

The “path to payback” for major machinery such as trucks might have been anywhere between three to five years, depending on the company as recent as 2012, Ryan describes during AMP Capital’s recent Capital Insights Forum.

With “quite a few” mining services companies now investing in new technologies – such as automated trucks and other technological developments in the segment improving efficiency – the payback period for a mining truck in the Pilbara, for instance, is now more like 18 months, he says.

Quicker turnarounds on return on investments could help mining services companies in particular progress through cycles quicker, Ryan reckons.

This could mean getting a head start on their global competitors, which can help the local names secure a strong position at the bottom of the cost curve, which could in turn help protect profitability in the event of any pullback in commodity demand, Ryan adds.

The technological efficiencies miners are finding coincides with a resurgence in commodity prices and a return to capex for the sector.

“We’ve noticed the miners have done an incredible job on the cost out, and that’s probably coming to an end now. With the new capex coming through we’ll be looking for miners in general to hold their cost levels and expand their operations. This should be good for some of the listed mining services names,” Ryan notes.

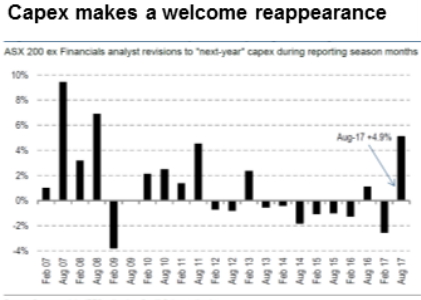

Mining services led the capex this earning season, Angus Nicholson, AMP Capital’s investment strategist notes.

Source: Company Data, IBES Estimates, Credit Suisse Estimates

This is the first time in six years the ASX has seen an increase in capex estimates, Ryan highlights.

The increasing capex provisions have been clustered in energy and commodity-related sectors and in the mining sector reflected much needed replacement capex after a few lean years of investment.

“So these companies have done a marvellous job driving down their unit costs and are now looking to open a new mine or do some drilling to bring on the next stage of production or prove up reserves,” Ryan explains.

Ryan also adds this is a positive sign for the broader economy, which has been dogged by anaemic economic growth.

“This is a positive trend for the economy and hopefully one that continues,” Ryan concludes.

Investors looking at the mining sector could expect to take advantage of dividends in the sector between now and the next earnings season, Ryan adds.

“The miners have come back from being in a precarious position and are now back to positions where they are able to pay out a large amount of cash flow. These are obviously cyclical dividends but they’ll be paying strong dividends now. And with the commodity uplift coming through the market, it should bode well good for next reporting season as well,” Ryan comments.

Source: AMP Capital 14 September 2017

Author: Dermot Ryan – Direct Equities Portfolio Manager

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.