Residential property has become the new religion in Australia. The buoyant market, particularly in Sydney and Melbourne where house prices have jumped 75% and 50% respectively in recent years, means residential is constantly talked about and analysed.

But as more and more baby boomers move into retirement, there is a growing need to seek investments that provide reliable income streams and protect against the unique risks they face such as inflation.

So long as Australians associate ‘property’ with ‘residential’, there is a danger they will ignore commercial property — an asset class that has historically delivered the very stable income, defensive attributes and potential for solid long-term gains that retirees require today.

More Australians, particularly retirees, therefore, need to start looking beyond residential and understand the 5 key advantages of commercial property.

1. BULK OF RETURNS FROM INCOME

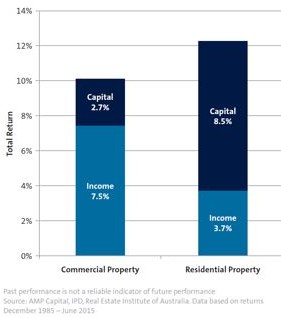

The first advantage of commercial property – retail, industrial and office – is that income underpins commercial property as a great investment. Over the past 30 years, commercial property has delivered total returns of 9 per cent a year. In general, some 2 per cent of the total return has been capital growth. The remainder 7 per cent is income – that’s more than double the standard term deposit rates, albeit with more risk.

By contrast, capital growth dominates residential returns. If we use a three-bedroom home in Sydney or Melbourne as proxy, residential property delivered a greater total return over the past thirty years. However, some 7 per cent of the total residential return was capital growth. That left income at just 3 per cent.

2. A STABLE INCOME SOURCE

Importantly, the income investors earn from commercial property is stable. Tenants, such as businesses and government, lease buildings generally for between 3 to 10 years, sometimes longer. Those long-term leases provide income security.

For example, our Wholesale Australian Property Fund acquired the Codan Building, a campus-style facility in Adelaide suburb of Mawson Lakes for $32.1 million in March this year. The building is fully leased to Codan, an ASX-listed company with a strong track record. The tenant signed a new 15-year lease that started in December 2015 with a 10-year option, and the property provides an initial income return of over 7.5 per cent.

For example, our Wholesale Australian Property Fund acquired the Codan Building, a campus-style facility in Adelaide suburb of Mawson Lakes for $32.1 million in March this year. The building is fully leased to Codan, an ASX-listed company with a strong track record. The tenant signed a new 15-year lease that started in December 2015 with a 10-year option, and the property provides an initial income return of over 7.5 per cent.

Residential tenants, however, typically sign up for just 6 to 12 months, and in most states they can break that lease with 8 weeks’ notice.

Within commercial property’s longer leases are fixed escalations in rent – each year rents are increased at an agreed rate of around 3 to 4.5 per cent.

There is also much less chance of a commercial property being damaged by a rogue tenant.

3. PORTFOLIO DIVERSIFICATION

Commercial property also has a low correlation to equities, which makes it relatively stable when markets are volatile.

Firstly, the market prices commercial property funds based on valuations which mean a lot of the day-to-day volatility is smoothed out, both relative to the equities market and even relative to listed property options.

Secondly, in a downturn total property returns can fall hard and dramatically, but the income from commercial property is less impacted in the short term because of legally binding leases. Because they have signed up to long-term rental agreements, the tenant must keep paying their rent each year, regardless of whether their profits rise or fall.

That low correlation to equities, and relative stability, means commercial property provides excellent portfolio diversification and some protection from downside risk.

4. INFLATION HEDGE

Additionally, commercial property is an excellent hedge against inflation, one of the biggest risks for retirees. When inflation accelerates, price rises flow through to higher profits, and in turn that flows through to higher rents and rising land values for commercial property. Historically, commercial property values have tended to rise at rates similar to inflation. That relationship has held for a very long time.

Commercial property therefore provides protection against an unexpected inflation spike. These spikes can have a double-whammy effect on retirees: not only does the price of day-to-day items such as food go up, but core defensive assets such as government bonds suffer.

Commercial property preserves the ‘real’ (after inflation) value of a retiree’s portfolio, allowing the income returns they generate to grow at a similar rate to the cost of living.

5. STRONG RETURN OUTLOOK

And finally, commercial property also offers a solid return outlook.

We have seen commercial property prices rise in recent years. Investors have been attracted to the sector’s yields in a low interest rate environment. Given our view that interest rates are set to remain low over the medium-term (the next three years or so), we believe that trend has further to run.

Overall we expect commercial property to deliver a 7-8% total return over the medium term, with about 5-6% in income and the remainder in capital growth. That outlook is based on deals we are seeing and executing, where commercial property is being valued and sold on the expectation of a 7 to 8% return.

Looking beyond residential

When we look around at other sources of income and asset classes, the outlook for returns from commercial property is excellent.

Cash and term deposits are no longer adequate sources of income, and The Reserve Bank is unlikely to raise rates aggressively any time soon. Traditional asset classes such as stocks and bonds face the large-scale challenges posed by both slowing global economic growth and historically low interest rates.

Geopolitical tensions, such as North Korea’s missile program and China’s territorial dispute with neighbouring countries over the South China Sea, is instilling further uncertainty in financial markets.

While residential property has been strong, and a crash is unlikely, its growth is now moderating. Combined, the solid returns, stable income, and low correlation to equities that commercial property offers makes it an extremely attractive investment for Australians, particularly retirees seeking reliable income streams and protection against sequencing and inflation risk.

It’s time for Australian investors, particularly retirees, to look beyond residential and consider investing in commercial property.

Upcoming webinar

Join Christopher Davitt, Fund Manager for the AMP Capital Wholesale Australian Property Fund as he provides an update on the Fund and discusses recent properties that have been purchased. Tuesday 19 September 2017, 2pm-3pm. Register now.

It’s important to be aware that there are risks associated with investing in the Wholesale Australian Property Fund. Before investing, please read the Product Disclosure State which can be found by visiting our website.

Source: AMP Capital 14 September 2017

Author: Christopher Davitt is Fund Manager for the AMP Capital Wholesale Australian Property Fund and Australian Property Fund.

Important note: Investors should consider the Product Disclosure Statement (“PDS”) available from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (“AMP Capital”) for the Wholesale Australian Property Fund (“Fund”) before making any decision regarding the Fund. The PDS contains important information about investing in the Fund and it is important investors read the PDS before making a decision about whether to acquire, continue to hold or dispose of units in the Fund. National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (“NMFM”) is the responsible entity of the Fund and the issuer of units in the Fund. Neither AMP Capital, NMFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance.

While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors and their advisers should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.